ANZ Bank Credit Card Account :

Generally well known as the ANZ Bank, (Australia and New Zealand Banking Group Ltd), is a well-known Australian global banking and monetary service organization. It has its headquarter located in Melbourne, Australia. The Bank is the second biggest banking organization by resources and the third-biggest bank by market capitalization in Australia.

ANZ Bank was founded on 1st October 1951, when the Bank of Australasia amalgamated with the Union Bank of Australia Limited. It is one of the large four Australian banks, along with the National Australia Bank (NAB), Commonwealth Bank, and Westpac.

Additionally, along with the operations all across Australia and New Zealand, ANZ Bank also controls its financial services in 34 different nations. ANZ Bank along with its subsidiaries has a well-trained workforce of over 51,000 representatives and serves around 9,000,000 clients around the world. Within Australia, the bank serves around 6,000,000 clients at more than 570 branches.

Since its establishment, ANZ has changed itself on many occasions, converged with 15 different banks, purchased and sold resources, moved hemispheres, and constructed its business with the help and support of its clients. Throughout decades, ANZ’s people with their hard work have built up a developed and unconventional bank, which has stood the test of time.

The ANZ Banking group operates in over 33 business markets worldwide with the portrayal in Australia, New Zealand, Europe, America, Asia, Pacific, and the Middle East. ANZ Bank is among the topmost 4 banks in Australia, the biggest financial group in New Zealand and the Pacific, and stands among the best 50 banks in the global market. ANZ’s global administrative office is situated in Melbourne, Australia. It originally opened as the First Bank of Australasia in Sydney in the year 1835 and also started in Melbourne in 1838 and their set of experiences includes a wide range of banks.

The ANZ Bank’s main intention is to shape a global society where individuals and communities can flourish. That is the reason they endeavor to make a maintainable decent, economy in which everybody can survive and fabricate a superior life. With the quick evolution of modern technologies and advancements, environmental changes, and globalization accompanying both difficulties and opportunities, they presently have a significant task to carry out in empowering monetary investment and empowering sustainable development of the society.

The organization’s methodology is centered around improving the monetary prosperity of its clients. They accept and believe that the execution of their focused strategy will convey good returns for their investors and shareholders. While accomplishing a harmony among development and return in both short and long term execution, and will impact financially and socially among the community they serve.

How to Activate an ANZ Bank Credit Card :

To Activate an ANZ Bank Credit Card, “Log In” to your Internet Banking Account, then select the “Activate an ANZ Card” on the credit card page and follow the on-screen prompts.

ANZ Bank official website link: www.anz.com.au

Activate through Phone:

You can call ANZ Customer Care Service at 1 -800 -652 -033 (within Australia) and +61 -3 -8699 -6996 (Calling from Overseas) to Activate your ANZ Credit Card from your phone.

Activate using ANZ Mobile Application:

You need to download the ANZ Mobile Application on your phone, then “Log In” to the ANZ Bank mobile application, then find and tap on the “More” option, then press the “Activate Card” option. Here you can also set your eligible credit card PIN on the same page. So there is no requirement for waiting for the PIN in your Email Inbox.

How to Log In for an ANZ Bank Credit Card :

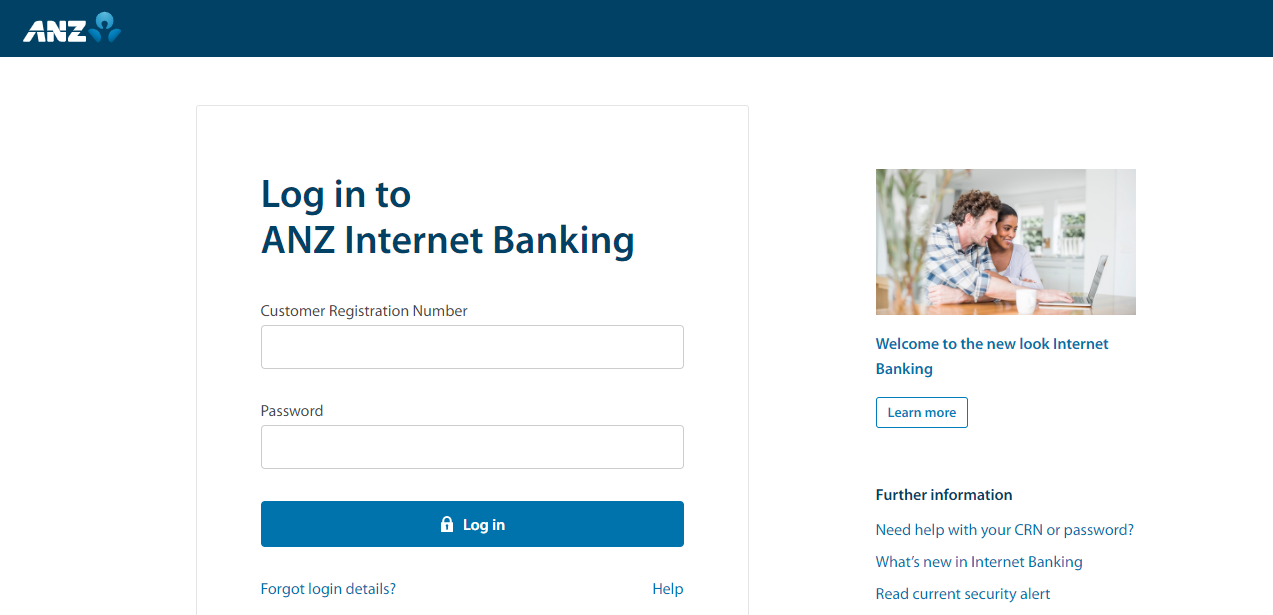

To Log In for the ANZ Bank Credit C, you need to follow the below guidelines:

- Go to the official website of the ANZ Bank.

- You can also click on the link given www.anz.com.au.

- On the landing page of the website, press the “Log In” bar on the right side, or directly go to the www.anz.com/INETBANK/login.asp page.

- Now on the next page, put your “Customer Registration Number” and “Password” on the given field.

- Tapping on the “Log In” bar below, you can get into your account.

How to Apply for the ANZ Bank Credit Card

To Apply for the ANZ Bank Credit Card, on the main landing page of the site, select the “APPLY” under the Log In tab. Then by tapping on the “Credit Card” option go to the credit card page. Here you can select your ANZ Credit Cards as per your need and Apply conveniently.

How to get Registered for the ANZ Bank Credit Card

To get Registered for the ANZ Bank Credit Card, you can call 13 -33 -50 (Within Australia) and +61 -3 -9699 -6908 or +61 -3 -9683 -8833 (Calling from Overseas) to get the Customer Registration Number (CRN) and Tele Code. You can also change your Tele Code to a number you have selected between 4 to 7 digits. Now you can get registered online using your CRN and Tele Code.

Go to the ANZ Internet Banking Registration page, from the official landing page under the LOG IN tab. Put down your “Customer Registration Number” (CRN) and “Tele Code” and tap on the “Next” button to go with the guidelines and get registered.

Various Credit Cards offered by ANZ Bank :

ANZ BANK REWARDS CREDIT CARDS

The ANZ Bank is presently offering 4 (four) credit cards. Those are:

ANZ Rewards Black Credit Card:

You have the potential of earning the highest Reward Points, uncovered flexible rewards points, and get access to exclusive privileges and events.

Benefits and Advantages:

- Avail the advantage of earning 1,80,000 Reward Bonus Points, after you spend $2,000 on approved purchases, within the first 3 (three) months from your account opening.

- Utilizing this ANZ Rewards Black Credit Card you will get a credit limit of $15,000 depending on your creditworthiness.

- You get the benefit of earning 2 (two) Rewards Bonus Points, spending per $1 on approved purchases up to $5,000 on per statement period. Additionally, you get an extra 1 (one) Rewards Bonus Points, spending per $1 on approved purchases above $5,000 on per statement period.

Also Read : Activate your Sodex Credit Card Online

ANZ Rewards Travel Adventures Credit Cards:

Without any international transaction charges, this particular credit card has all your traveling and shopping requirements covered with a complimentary insurance and you can also get access to a flexible Rewards program.

Benefits and Advantages:

- You can avail the advantage of earning 40,000 Reward Bonus Points, after you spend $1,000 on approved purchases, within the first 3 (three) months from your account opening.

- Utilizing this ANZ Rewards Travel Adventures Credit Card you will get a credit limit of $6,000 depending on your creditworthiness.

- You get the benefit of earning 1.5 Rewards Bonus Points, spending per $1 on approved purchases up to $2,000 on per statement period. Additionally, you get an extra 0.5 Rewards Bonus Points, spending per $1 on approved purchases above $2,000 on per statement period.

ANZ Rewards Platinum Credit Cards:

You can get rewarded for your regular purchases and can get access to a flexible Rewards Program with free of charge insurances and a Personal Concierge.

Benefits and Advantages:

- Get the advantage of earning 1,20,000 Reward Bonus Points, after you spend $1,500 on approved purchases, within the first 3 (three) months from your account opening.

- Using this ANZ Rewards Platinum credit card you will get a credit limit of $6,000 depending on your creditworthiness.

- You can avail the benefit of earning 1.5 Rewards Bonus Points, spending per $1 on approved purchases up to $2,000 on per statement period. Additionally, you get an extra 0.5 Rewards Bonus Points, spending per $1 on approved purchases above $2,000 on per statement period.

ANZ Rewards Credit Cards:

Take the advantages of being rewarded for your regular purchases and avail yourself the simplicity to redeem your points for bonus rewards from Money Back to Gift Cards and Travel.

Benefits and Advantages:

- Get the advantage of earning 50,000 Reward Bonus Points, after you spend $1,000 on approved purchases, within the first 3 (three) months from your account opening.

- Using this ANZ Rewards Platinum Credit Card you will get a credit limit of $1,000 depending on your creditworthiness.

- You can avail the benefit of earning 1 (one) Rewards Bonus Points, spending per $1 on approved purchases up to $1,000 per statement period. Additionally, you get an extra 0.5 Rewards Bonus Points, spending per $1 on approved purchases above $1,000 per statement period.

Rates and Interests (Applied to All above ANZ Bank REWARDS Credit Cards):

- Annual Fees – ANZ Rewards Black: $375, ANZ Rewards Travel Adventures: $120, ANZ Rewards Platinum: $95, and ANZ Rewards: $80.

- Interest Rate on Purchases – The charge is 20.24% annually.

- Interest Rate on Purchases (Promotional) – N/A.

- Interest Rate on Cash Advances – The charge is 20.24% annually.

- Interest Rate on Standard Balance Transfers – The charge is 20.24% annually.

- Purchase Interest-Free Days – Limit Up to 55 Days.

- Additional Cardholders Fee – An Annual Fee of $65 per additional cardholder, up to a limit of 9 (nine) cardholders and up to 3 (three) cardholders applicable only for ANZ Rewards Credit Card.

ANZ BANK LOW-INTEREST RATE CREDIT CARD :

The ANZ Bank is offering this credit card along with a Lowest Interest Rate for your regular purchases.

Benefits and Advantages:

- Avail the advantage of paying a 0% fee annually for the first 20 (twenty) months, on your Transfer of Balances. Moreover, you get to pay a $0 (No Fee) as Annual Fee for the first year.

- With this ANZ Bank Low-Interest Rate Credit Card, you will get a credit limit of $1,000 depending on your creditworthiness.

- Along with this card, you can be benefitted from ANZ Fraud Money Back Guarantee, Emergency Cash Advances, Emergency Credit Card Replacement Globally, and your Credit Limit can get increased during your emergency requirement.

Rates and Interests:

- Annual Fees – You have to pay $0 (No Fee) for the first year, afterward, you will be charged $58 annually.

- Interest Rate on Purchases – The charge is 12.49% annually.

- Interest Rate on Cash Advances – The charge is 20.24% annually.

- Interest Rate on Standard Balance Transfers – A promotional rate of 0% annually is charged for the first 20 (twenty) months, afterward the charge is 20.24% annually.

- Purchase Interest-Free Days – Limit Up to 55 Days.

- Additional Cardholders Fee – No additional cost is charged up to 3 (three) cardholders for ANZ Bank Low-Interest Rate Credit Card.

ANZ BANK LOW ANNUAL FEE CREDIT CARDS :

ANZ First Credit Cards:

With a low ongoing Annual Fee, it is a simple everyday credit card.

Benefits and Advantages:

- You will be charged $30 as Low Annual Fees.

- As a welcome offer, you have the advantage of paying 0% interest on purchases annually for your first 12 (twelve) months. Afterward, you will be charged 20.24% annually.

- Using this credit card you get back $30 as money back, with your new ANZ First Credit Card.

- With this ANZ Bank First Credit Card, you will get a credit limit of $1,000 depending on your creditworthiness.

ANZ Platinum Credit Card:

Avail the advantage of a simple regular usable credit card with a $0 annual fee for the first year plus free of cost insurance coverages.

Benefits and Advantages:

- You get an introductory offer of paying $0, as Annual Fees for the first year. After that period you will be charged $87 annually as Annual Fees. Additionally, you can get the benefit of continuing to pay $0 annually, if you spend $20,000 on eligible purchases within 12 months.

- As a welcome offer, you have the advantage of paying 0% interest on purchases annually for your first 17 (seventeen) months. Afterward, you will be charged 20.24% annually.

- With this ANZ Bank First Credit Card, you will get a credit limit of $6,000 depending on your creditworthiness.

Rates and Interests (Applicable for both ANZ First and ANZ Platinum Credit Cards):

- Annual Fees – You have to pay $30 for the ANZ First Credit Card, and for the ANZ Platinum Credit Card pay $0 (No Fee) for first-year afterward you will be charged $87 annually.

- Interest Rate on Purchases – The charge is 20.24% annually.

- Interest Rate on Cash Advances – The charge is 20.24% annually.

- Interest Rate on Standard Balance Transfers – The charge is 20.24% annually.

- Interest Rate on Standard Balance Transfers (Promotional) – For ANZ First Credit Card a welcome rate of 0% annually is charged for the first 12 (twelve) months, and For ANZ Platinum Credit Card a welcome rate of 0% annually is charged for the first 17 (seventeen) months, and after the promotional period the charge is 20.24% annually on Balance Transfers applicable for both credit cards.

- Purchase Interest-Free Days – Limit Up to 55 Days.

- Additional Cardholders Fee – For the ANZ First Credit Card no additional cost is charged up to 3 (three) cardholders and for the ANZ Platinum Credit Card no additional cost is applied up to 9 (nine) cardholders.

ANZ BANK FREQUENT FLYER CREDIT CARD :

The ANZ Bank is offering 3 (three) Frequent Flyer Credit Cards. Those are:

ANZ Frequent Flyer Credit Card:

Benefits and Advantages:

- Get the advantage of 25,000 Qantas Bonus Points, using your ANZ Frequent Flyer Credit Card, after you spend $1,000 on approved purchases, within the first 3 (three) months from your account opening.

- Utilizing this ANZ Frequent Flyer Credit Card you will get a credit limit of $1,000 depending on your creditworthiness.

- Additionally, you can avail extra 0.5 Qantas Bonus Points for spending per $1 on approved buys up to $500 per statement period and more 0.25 Qantas Bonus Points for spending per $1 on approved buys over $500 per statement period.

ANZ Frequent Flyer Black Credit Card:

Benefits and Advantages:

- You get the benefit of 1,20,000 Qantas Bonus Points, utilizing your ANZ Frequent Flyer Black Credit Card, after you spend $3,000 on approved purchases, within the first 3 (three) months from your account opening.

- Utilizing this ANZ Frequent Flyer Black Credit Card you will get a credit limit of $15,000 depending on your creditworthiness.

- Moreover, avail extra 1 (one) Qantas Bonus Points for spending per $1 on approved buys up to $7,500 per statement period and more 0.5 Qantas Bonus Points for spending per $1 on approved buys over $7,500 per statement period.

ANZ Frequent Flyer Platinum Credit Card:

Benefits and Advantages:

- Avail the facility of getting the advantage of 75,000 Qantas Bonus Points, with your ANZ Frequent Flyer Platinum Credit Card, after you spend $2,500 on approved purchases, within the first 3 (three) months from your account opening.

- Utilizing this ANZ Frequent Flyer Platinum Credit Card you will get a credit limit of $6,000 depending on your creditworthiness.

- Additionally, you can avail of extra 0.75 Qantas Bonus Points for spending per $1 on approved buys up to $3,000 per statement period and more 0.5 Qantas Bonus Points for spending per $1 on approved buys over $3,000 per statement period.

Rates and Interests (Applicable to All ANZ Frequent Flyer Credit Cards):

- Annual Fees – ANZ Frequent Flyer: $95, ANZ Frequent Flyer Black: $425, and ANZ Frequent Flyer Platinum: $295.

- Interest Rate on Purchases – The charge is 20.24% annually.

- Interest Rate on Purchases (Promotional) – N/A.

- Interest Rate on Cash Advances – The charge is 20.24% annually.

- Interest Rate on Standard Balance Transfers – The charge is 20.24% annually.

- Interest Rate on Standard Balance Transfers (Promotional): N/A.

- Purchase Interest-Free Days – Limit Up to 55 Days.

- Additional Cardholders Fee – An Annual Fee of $65 per additional cardholder, up to a limit of 9 (nine) cardholders applicable for ANZ Frequent Flyer Black and ANZ Frequent Flyer Platinum and up to 3 (three) cardholders applicable only for ANZ Frequent Flyer Credit Card.

Contact Details:

Address: Australia and New Zealand Banking Group Limited (Melbourne Office):

ANZ Centre Melbourne, Level 9

833 Collins Street, Docklands,

Victoria 3008, Australia

Address: Australia and New Zealand Banking Group Limited (Sydney Office):

ANZ Towers, 242 Pitt Street,

NSW 2000, Australia

Mail To: ANZ Complaint Resolution Team

Locked Bag 4050, South Melbourne VIC 3205

Phone Numbers:

General Queries (Call): 13 -13 -14 (Within Australia) and + 61 -3 -9683 -9999 (Calling from Overseas)

Internet Banking Queries (Call): 13 -13 -50 (Within Australia) and + 61 -3 -9683 -8833 (Calling from Overseas)

For ANZ Online Registration (Call): 13 -33 -50 (Within Australia)

For ANZ Online Registration (Call): + 61 -3 -9699 -6908 or + 61 -3 -9683 -8833 (Calling from Overseas)

For ANZ Credit Card Activation (Call): 1 -800 -652 -033 (Within Australia) and + 61 -3 -8699 -6996 (Calling from Overseas)

For Lost or Stolen Credit Card (Call): 1800 -033 -844 (Within Australia) and + 61 -3 -8699 -6955 (Calling from Overseas)

ANZ Complaint Resolution Team (Call): 1800 -805 -154

For Deaf, Hard of Hearing People (Call): 133 -677

Reference Link:

www.anz.com/INETBANK/login.asp

www.anz.com.au/support/help/how-to/activate-my-card