How to Activate Barclaycard Credit Card :

Barclaycard is the trading name for credit cards issued and approved by Barclays PLC (Public Limited Company) and Barclaycard International Payments Limited. As per the data of 2010, at that time Barclays had more than ten million clients in the United Kingdom. The company launched its brand named Barclaycard on 29 June 1966, as a first charge card, but by following the agreement done by the Bank of England, on 8 November 1967 towards the contribution of rotating credit, it turned into the primary Credit Card in the United Kingdom. The company had enjoyed the advantages of monopoly market leader of the Credit Card business market in the United Kingdom, until the appearance of the Access Card in October 1972.

Barclays is a globally well-known investment banking and financial service provider organization, located in London, England (UK). Additionally, from investment banking, Barclays also operates four core business sectors like wealth management, individual banking, corporate banking, and investment management.

Earlier in the year, 1690 Barclays started its journey as a goldsmith banking business established in the City of London. In the year 1728, the bank shifted its administrative office to 54, Lombard Street, and was recognized by the logo of “Representation of the Black Spread Eagle”, which in later years turn out to be a core part of the bank’s visual impression and identification in the financial market. In the year 1736, the official name “Barclays” got attached to the business when Mr. James Barclay joined the team as a partner in the business.

Nowadays, Barclays got listed on the London Stock Exchange (LSE) and is a section of the Financial Times Stock Exchange – FTSE 100 Index. The association is also listed and recorded on the New York Stock Exchange (NYSE).

At Barclaycard, they use the latest tech-driven solutions and data analysis for helping to make a business-to-business payment more simple and proficient. Their consultative payments specialists can assist you with finding that smart techniques to save your hard earn business cash and present you with all the most recent awareness of the industry knowledge in business-to-business payments. Additionally of whether you’re in treasury, procurement, or finance, they can help you to think and re-consider if your payment system is the correct one for your business or not. Barclaycard keeps things straightforward with a worldwide acknowledged payment method – the simplified method to manage your high-volume transactions, expenses, and international travel in one spot. It sets spending plans across groups and departments to diminish or wipe out the requirement for petty cash on low-value, high-volume or periodic business buys. The organization’s Fuel card primarily manages your business fuel expenses and vehicle fleets and light merchandise vehicles with Fuel, which is generally acknowledged all across UK and Europe.

Activate your Barclaycard Credit Card :

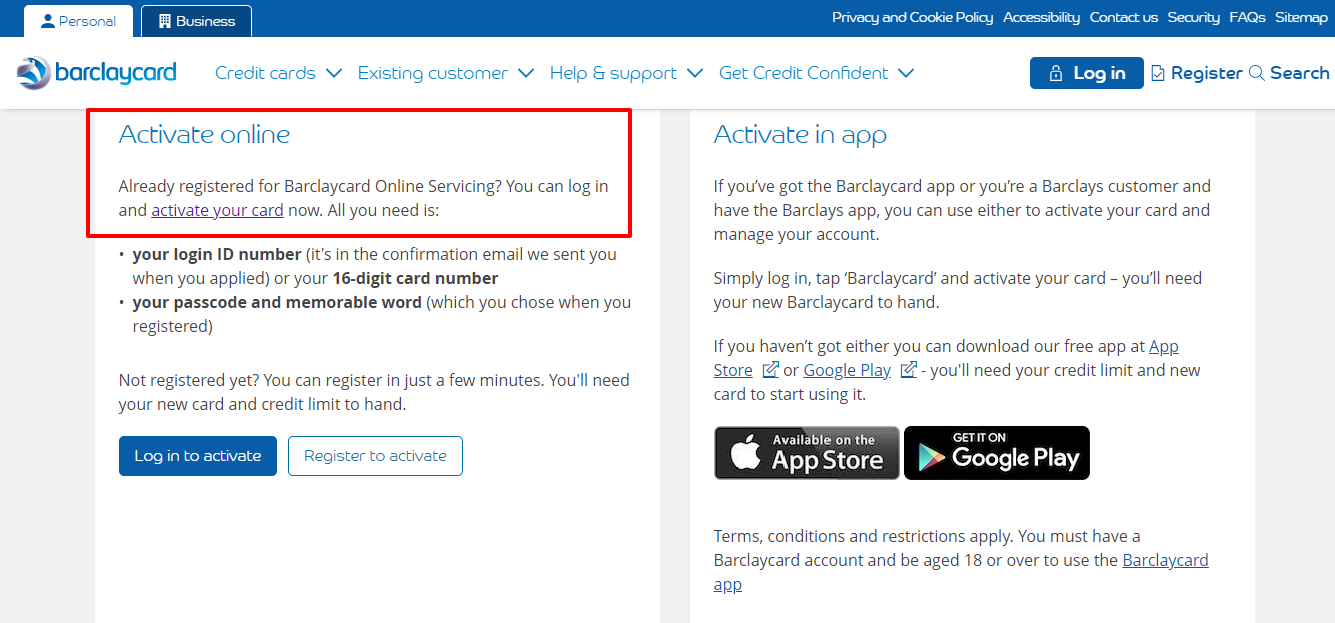

To Activate a Barclaycard Credit Card, follow the simple steps below:

- Go to the official landing page of the Barclaycard website.

- You can also click on the link www.barclaycard.co.uk

- On the page find and click on the “Activate Your Card Online”, under the “Help with your Account”

- Here on another page, you will find options “Log In to Activate” and “Register to Active”, or go to www.barclaycard.co.uk/activate

- Choose the option as per your need, and follow to on-screen prompts to activate your credit card.

Register for Barclaycard Credit Card :

To get Register for the Barclaycard Credit Card, go with the underlying guidelines:

Requirements to Get Register :

- Keep your Barclaycard in hand.

- Details of your Credit Limit (Find it with your letter or latest statement that came with your credit card).

- In order to register you need to be the primary cardholder.

- For your online security measures, the organization is providing you 5 (five) minutes to complete the registration process.

- Please make sure that you have enabled the cookies in your browser, to get into the correct page and to Log In as quickly as possible.

Also Read : Activation Guide for US Bank Card Online

Guidelines to Register :

- On the landing page of Barclaycard, click on the “Register” tab on the top right corner of the webpage.

- By tapping on the option “Register Your Account” bar on this page, you will be deferred to another page.

- Here under the “Register Your Account” heading, put down your Card Number (16 Digit number on the front side of the Card), Card Security Code / CVV Number (Last 3 numbers on the back side of your Card), Expiry Date (MM/ YY), Date of Birth (DD /MM/ YYYY), Create A Username and Enter (Minimum 8 to 16 characters long, Keep at least 1 number, 1 letter, and Do not use any Special Characters), Create a Pass Code: Enter and Confirm Pass Code (Minimum 6 numbers, Must contain only Numbers, Do not repeat numbers more than 2 times, Not more than 3 numbers, in turn, Do not use your Date of Birth), Create a Memorable Word: Enter and Confirm Memorable Word (Minimum with 6 to 8 letters, Use only letters A – Z, No repeated letters more than 2 times, Do not use more than 2 letters in turn, Do not use any keyboard sequence or any kind of special characters, Do not use your last name), Create a Memorable Word Remainder ( It can be your memorable word or any kind of special characters), Email Address, etc.

- Now check the box for Barclaycard Terms and Conditions and press the “REGISTER”

Please Note: You can also Register and Log In using the Barclaycard Mobile Application.

Barclaycard Credit Card Login :

To get login for the Barclaycard Credit Card, follow the steps stated below:

- Visit the authoritative website of Barclaycard.

- Or else you can tap on the link given www.barclaycard.co.uk

- Here on the landing page you will find and press on the “Log In” tab option.

- On another page put your “Username or ID Number”.

- Now click on the “NEXT” button and follow the screen guidelines.

How to Apply for the Barclaycard Credit Card :

To Apply for the Barclaycard Credit Card, go to the landing page of Barclaycard’s website. Then by choosing the “Credit Card” option, go to the cards page. Now select your card as per your requirement and “Apply”.

Various Credit Cards offered by Barclaycard :

A Credit Card may be a flexible method of borrowing cash. Utilizing the correct credit card, as per your requirement, you can take control of your finances, spread out the expenses of the things you want to buy for your regular use, and earn rewards for your regular expenses.

There are several Credit cards offered by Barclaycard. Those are briefly discussed below:

BARCLAYCARD BALANCE TRANSFER CREDIT CARD :

Up to 24 Month Balance Transfer Platinum Card

Benefits:

- Utilizing this card you get the maximum flexibility and more time to pay off your balances.

- From the date, you open your account, pay a 0% interest for up to 24 months on balance transfer. To get benefitted from the offer you must transfer your balance within the first 60 days.

- Avail a 0% interest on purchase for up to 6 months, from your account opening date.

- Get the advantage of a 1% Balance Transfer Fee.

Up to 18 Month Balance Transfer and 20 Month for Purchases Card :

Benefits:

- For your transfer of balances and purchases, it’s a flexible card to use.

- Avail of the benefit of up to 20 months of paying 0% interest on purchases, from the date of your account opening.

- Get the advantage from the date you open your account for paying a 0% interest for up to 24 months on balance transfer. To get benefitted from the offer you must transfer your balance within the first 60 days.

- Utilizing this card pay 2.9% on the Balance Transfer fee.

Up to 15 Month Balance Transfer Platinum Card :

Benefits:

- If you are looking for a credit card to transfer your balances and do not want to pay any fee, this card can be beneficial to you.

- Since your account opening date, pay the interest of 0%, for up to 24 months on your balance transfer. To get the benefit from the offer you must transfer your balance within the first 60 days.

- You have to pay a 0% interest on purchase for up to 6 months, from your account opening date.

- Get the advantage of a 0% fee for all your Balance Transfers.

Rates and Charges (Applicable to All 3 (three) Credit Cards Above):

- Annual Fee – No Annual Fee ($0)

- Representative APR – 21.9% (A Variable Annual Percentage Rate will be applicable)

- Purchase Rate – 21.9% (A Variable Purchase Rate will be charged annually)

- Credit Limit – £1,200 (Based on your Creditworthiness)

BARCLAYCARD REWARD CREDIT CARD

Utilizing the Barclaycard Reward Credit Card, you can straightaway start your reward earnings whenever you use the card. On every pound you spend on your new purchases, you get the benefit of getting Cash Back Rewards.

Benefits:

- On every pound, you spend to get the reward of Cash Back.

- The Money-back will be paid into your account directly. The amount will be credited annually in your statement or as per your request made. By using the card every time, you can get something back genuinely.

- Every time you make a new purchase, you get 0.25% Money-Back every day.

- There are no fees for overseas cash withdrawal from ATM or you can buy your souvenirs without paying any charges and get the benefit of Visa’s competitive exchange rate.

Rates and Charges for Reward Credit Card:

- Annual Fee – No Annual Fee ($0)

- Representative APR – 22.9% (A Variable Annual Percentage Rate will be applicable)

- Purchase Rate – 22.9% (A Variable Purchase Rate will be charged annually)

- Credit Limit – £1,200 (Based on your Creditworthiness)

BARCLAYCARD FORWARD CREDIT CARD

Barclaycard provides these forward credit cards to their customers to help them build their credit profiles. If you are looking for your first-ever credit card, then this is the right one for you. A forward credit card is usually offered to people who do not have a credit history or have a limited credit history by still require a credit card.

Benefits:

- Your credit limit will be of £50 to £1,200, depending on your credit status.

- Barclaycard provides you a price promise of a 3% interest rate that will be reduced when during your first year tenure, you make all your payments in due time. If you keep it maintained in the 2nd year also, you can get an additional benefit of a 2% reduction in interest rate.

- From the date, you have opened your account, avail the advantages of paying a 0% interest for up to 3 (three) months.

Rates and Charges for Reward Credit Card:

- Annual Fee – No Annual Fee ($0)

- Representative APR – 33.9% (A Variable Annual Percentage Rate will be applicable)

- Purchase Rate – 33.9% (A Variable Purchase Rate will be charged annually)

- Credit Limit – £1,200 (Based on your Creditworthiness)

Contact Details:

Mail for General Queries:

Barclaycard House,

1234 Pavilion Drive, Northampton,

NNA 7SG, Mail Van Area 24

Mail for Fraud:

Dept KK,

51 Saffron Road, Leicester, LE18 4US

Mail For Payments: (If you post a Cheque for Payment, Please write your Name, Post Code, and Credit Card Number on the back of your Cheque)

Barclaycard, PO Box – 292

SHEFFIELD S98 1SD

Phone Numbers:

Customer Care Service (Call): 0800 -151 -0900 (Monday to Friday 7 am to 8 pm and Saturday to Sunday 9 am to 5 pm)

Customer Care Service (Call): +44 – (0) -1604 -230 -230 (For Outside of UK Customers) (Monday to Sunday 8 am to 8 pm)

For Lost or Stolen Credit Card (Call): 01604 -230 -230 (Within UK)

For Lost or Stolen Credit Card (Call): +44 -1604 -230 -230 (For Outside of UK Customers)

Reference Link:

www.barclaycard.co.uk/activate