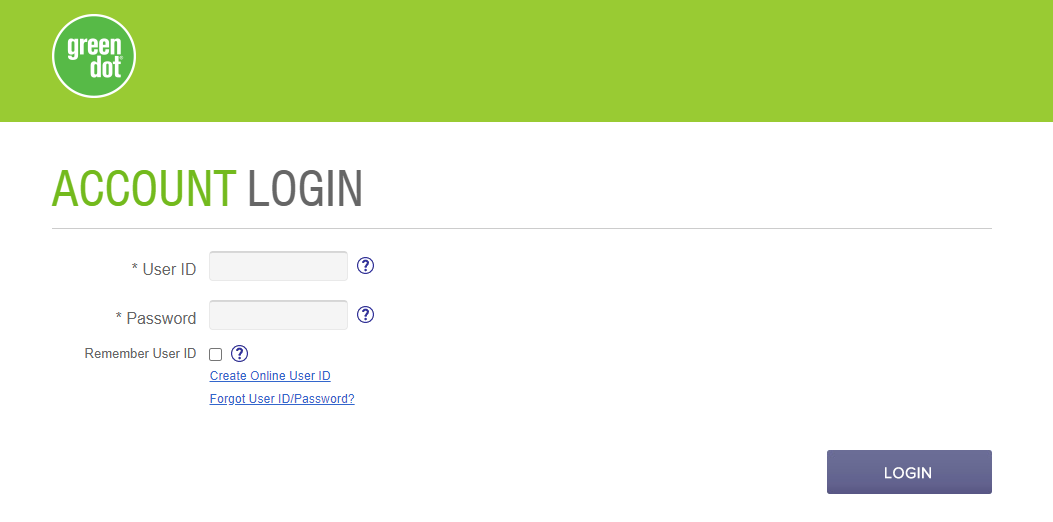

How to Log In for a Green Dot Debit Card:

To Log In for a Green Dot Debit Card, follow the given instructions:

- Visit the authoritative website of Green Dot.

- Tap on the “Log In” option on the home page.

- Then on to the new “Account Login” webpage, put down your “User ID” and “Password” in the respective blank fields.

- Now by tapping on the “LOG IN” button below get into your account.

How to Open an Account for the Green Dot Debit Card:

To Open an Account for the Green Dot Debit Card, move on to the website of the organization. Choose and tap on the “Open An Account” option, on the home page. Now on the next page put down your “Email Address” and click on the “Get Started” option below and follow the on-screen guidelines.

Various Debit Cards as offered by Green Dot:

The Green Dot organization is offering numerous Debit Card, the cards are sold only in Green Dot outlets and in approved stores. It is not a traditional Gift Card. You must achieve the age of 18 or older to purchase the Green Dot Debit Card. You will need the Online Access and Identity Verification (including SSN) to open an account. To access all the features your valid Mobile Number or Email Address Verification and the Green Dot Mobile Application are required.

This Card is approved and issued by the Green Dot Bank, Member of Federal Deposit Insurance Corporation (FDIC), USA, and an approved license holder from Visa U.S.A Inc.

The Green Dot Debit Cards are briefly discussed below:

Green Dot Cash Back Visa Debit Card:

Benefits and Advantages:

Utilizing The Green Dot Cash Back Visa Debit Card, you can earn up to 2% Money Back on your purchases from online portals and mobile applications with no cap and additionally get up to 2% (APY) Interest on your savings up to $10,000 which is 20X more the national average.

- Free ATMs Access – Across the country get access to ATMs to withdraw cash at thousands of in-network teller machines.

- Free Cash Deposits – You can deposit money at certain major retailers utilizing the Green Dot Application including Rite Aid, CVS, Walmart, and Walgreens. Additionally, you can also make money deposits with a small fee, at the register of more than 90,000 retailers across the nation.

- Get paid Early – You can get your payments much quickly using ASAP Direct Deposit, i.e. up to 2 days earlier and along with your Government benefits up to 4 days earlier.

- Managing your Money more easily – Enjoy the advantage of 24X7 Mobile Banking, free bank transfers, free mobile check deposits, online bill payments, convenient account alerts, and lock /unlock feature using the Green Dot Application.

Rates and Interests:

- Purchase Price – $2.95

- Monthly Charges – $9.95

- Deposit your Cash utilizing the Green Dot Application – No Charges (Free)

- In-Network ATM Withdrawal – Free

- Out of Network Balance Inquiry at ATM – $0.50

- Out of Network ATM Withdrawal – $3.00 per transactions

- Teller Cash Withdrawal Fee – $3.00 per transactions

- Inactivity Fee – $9.95

- Paper Check Fee – $5.95 for a pack of 12 checks

- Direct Deposits – No fee for Direct Deposit

Green Dot Visa Debit Card:

Benefits and Advantages:

Using The Green Dot Visa Debit Card, you get the benefit of a full-featured account along with more smart banking features to help and support you for better access, budget, and managing your funds anywhere anytime, as per your need.

Furthermore, the company charges No Monthly maintenance fee and No Bank Transfer fees for the direct deposit of $500 or more in the previous monthly period, or else $7.95 per month is charged.

- Send Money – With just a few taps, you can transfer your money to other Green Dots accounts, it’s free, simple, and quick, and convenient.

- Get paid Early – Now your payments are much quicker using ASAP Direct Deposit, i.e. up to 2 days earlier and along with your Government benefits up to 4 days earlier.

- Set Aside Money – Utilizing the unique Vault feature, you can set aside your cash for a particular goal or for a rainy day.

- Payment with Mobile Wallet – As your Visa Card is accepted everywhere within the U.S., now make payment using the Mobile Wallet with Visa power it also works with Samsung Pay, Google Pay, and Apple Pay, etc.

Rates and Interests:

- Purchase Price – $1.95

- Monthly Charges – $7.95 (The fees is waived as you deposit directly $500 or more in your account, in the previous month)

- Deposit Cash using the Green Dot App – $4.95

- In-Network ATM Withdrawal – $3.00 per transaction

- Balance Inquiry at ATM’s – $0.50

- Teller Cash Withdrawal Fee – $3.00 per transactions

- For Lost, Stolen or Damaged Card Replacement – $5.00

- Foreign Transaction Fee – 3% of the total amount transferred

- Inactivity Fee – $7.95

- Paper Check Fee – $5.95 for a 12 checks pack

- Direct Deposits – No fee for Direct Deposit

Green Dot Card :

Green Dot is a registered bank holding and financial technology-based organization focused on building the present-day modernized Banking system and monetary services available for all. Established in the year 1999 and settled in Pasadena, CA, in the United States. Green Dots in its more than 20 years of banking innovation has served over 33 million clients till now directly and a lot more through its financial banking accomplices and now works generally as a “Branchless Bank” with over 90,000 retail distribution outlets across the country. The organization is presently listed on the New York Stock Exchange (NYSE) as GDOT.

The organization through their Direct Banking and Retail, offer a set-up of monetary products to Businesses and Consumers including Checking, Credit Card, Debit Card, Payroll Card, and Prepaid Card along with vigorous Cash processing services, Cash Deposits, Monetary disbursements, and Tax Reforms. Green Dots initiative “Banking as a Service” (BaaS) empowers a growing countdown of America’s most noticeable buyers and technology-based organizations to plan, design, and establish their own personalized banking and make money movement services all across the United States and globally.

Green Dots priority technology uses helps people to empower quicker, money management and make more productive electronic payments, controlling intuitive and consistent ways for customers to spend, control, send, and save their cash.

How to Activate a Green Dot Debit Card:

Green Dot is one of the market-leading service providers of prepaid debit cards, and they’re highly popular for their simplicity and convenient method of service. If you hold a new Green Dot Debit Card that you need to Activate or Register, you can do it easily through the online portal. For digital safety and security reasons, Green Dot does not allow you to activate or register your Debit Card over the telephone.

To Activate a Green Dot Debit Card, you need to follow the below guidelines:

- Go to the official website of Green Dot.

- Or else, you can click on the link given at www.greendot.com.

- On the landing page of the website, choose the “Register or Activate”

- Now on another page enter your 16-Digit Card Number, Expiration Date, and CVV (The 3- Digit Card Verification Value Security Code is the number printed flat on the right side of the signature panel on the backside of your Debit Card), etc.

- Then click on the “NEXT” button below and follow the on-screen instructions to complete your activation.

Green Dot Pay As You Go Visa Debit Card:

Benefits and Advantages:

You can get the advantage of easy solutions and flexibility with the Pay As You Go Visa Debit Card which offers you to pay your bills, shop, budgeting for your various daily expenses, and keep your money easy to access. In any situation, you can enjoy the benefit of no monthly maintenance or bank transfer fees just simply pay as per your usage.

- Send Money – Now you can transfer your money to another Green Dot Card with just a few clicks, it’s easy, fast, and free of charge.

- Get Cash – You can avail cash off on your card for free of charges. At the register when you make a purchase.

- Get your Payment Early – Payments are much quicker now by utilizing the ASAP Direct Deposit, i.e. up to 2 days earlier and along with your Government benefits up to 4 days earlier.

- Shop Everywhere – Take the benefit of using the Visa Card as it is accepted everywhere in the United States, now make payment using the Mobile Wallet with Visa power it also works with Samsung Pay, Google Pay, and Apple Pay, etc.

- Easily Add Cash – Now you can have the facility to deposit your money at many major retailers like Rite Aid, CVS, Walmart, and Walgreens using the Green Dot Application. Additionally, you can also make money deposits with a small fee, at the register of more than 90,000 retailers across the nation.

Rates and Interests:

- Purchase Price – $3.95

- Monthly Charges – $0.00

- Per Use Fee – $1.50

- Deposit Cash using the Green Dot App – $4.95

- In-Network ATM Withdrawal – $3.00 per transaction

- Balance Inquiry at ATM’s – $0.50

- Teller Cash Withdrawal Fee – $3.00 per transactions

- For Lost, Stolen or Damaged Card Replacement – $5.00

- Foreign Transaction Fee – 3% of the total amount transferred

- Inactivity Fee – $9.95

- Paper Check Fee – $5.95 for a 12 checks pack

- Direct Deposits – No fee for Direct Deposit.

Also Read : How to Access Comdata Cardholder Account

Green Dot 5% Cash Back Visa Debit Card:

Benefits and Advantages:

Enjoy the advantages of being getting rewarded for your everyday purchases, with the Green Dot 5% Cash Back Visa Debit Card. You can earn a 5% Cash Back with every time and everyday purchase, up to $100 annually, and rack up your rewards. This card is sold only in Green Dot Stores and approved outlets.

- Quickly Send Money – Help and support your friend or give a birthday gift by sending money to any Green Dot Bank-issued card in any place within the United States or add cash to your PayPal account.

- Bank on your Schedule – If you are on a Mountain trip or on a city tour, skip your banking schedule at your fingertips. Now track your transactions, account balance, and many more from your smartphone virtually anywhere.

- Make your Payday Faster – Utilizing the free ASAP Direct Deposit, you can make your payday on Wednesday and stop waiting for Friday.

- Do your Shopping Everywhere – You can now carry your card coast to coast within the United States and utilize it everywhere your Visa Card is accepted.

Rates and Interests:

- Purchase Price – $1.95 or Less

- Purchase Price Online – No Online Purchase Fee

- Monthly Charges – $9.95

- Reload at Register Fee – $4.95 or Less

- ATM Fees – $3.00 withdrawal and $0.50 for Balance Inquiry (extra fees may be charged by ATM owner)

- In-Network Teller Cash (ATM) Withdrawal – $3.00 per transaction

- Teller Cash Withdrawal Fee – $3.00 per transactions

- For Lost, Stolen or Damaged Card Replacement – $5.00

- Foreign Transaction Fee – 3% of the total amount transferred

- Direct Deposits – No fee for Direct Deposit

Green Dot Prepaid Debit Card:

It’s fast and simple to purchase a Green Dot Prepaid Debit Card. You can easily purchase your new Green Dot Debit Card at one of the thousands of retailers across the country including Rite Aid, 7- Eleven, Walgreens, CVS Pharmacy, Walmart, and many more. Firstly, after purchasing your new prepaid debit card you have to register your card, and then after your new customized debit card will be mailed to you. After activating your card properly you will be permitted to access all the features and benefits of your Green Dot Prepaid Debit Card.

Benefits and Advantages:

- No Bank Transfer Fee – Now you can transfer your cash from another bank to your Green Dot account to maintain your account in full and ready to use.

- Enjoy your true Mobile Banking – Now it doesn’t matter whether you are on a mountain trip or on a city tour you can easily skip your banking trip and track your account, review your transactions and many more anytime from your smartphone virtually.

- Shopping Everywhere is easy – Take the full benefit of your Prepaid Visa Debit Card as it is accepted everywhere in the United States, now make payment conveniently using the Mobile Wallet with Visa power, it also works with Samsung Pay, Google Pay, and Apple Pay, etc.

- Avail your Direct Deposit – Now you can utilize the ASAP Direct Deposit, to stop your waiting in the long check cashing lines, you can also avoid your check cashing fees, and get money automatically deposited and simultaneously enjoy your payday much earlier than ever before.

Rates and Interests:

- Card Purchase – $1.95

- Monthly Fees – $7.95 (The fees is waived as you deposit directly $1,000 or more in your account in the previous month)

- Per Purchase Fee – $0 (No Fees)

- ATM Withdrawal – $3.00

- Teller Cash Withdrawal – $3.00

- Cash Reload – $5.95

- ATM Balance Inquiry – $0.50

- Customer Service Fee – $0 (No Fees)

- Inactivity – $0 (No Fees)

- International Transactions – 3% of the United States Dollar amount of each transaction.

- Paper Checks (Pack of 12) – $5.95

- Card Replacement (Regular Delivery) – $5.00

- Card Replacement (Expedited Delivery) – $15.00

- VIP Upgrade – $4.95

Contact Details:

Green Dot Bank

P.O. Box – 5100,

Pasadena, California 91117

Phone Numbers:

Customer Care Service (Call): (866) -795 -7597

Consumer Financial Protection Bureau (CFPB) (Call): 1 -855 -411 -2372

Meta Description:

We trust that this article has given a legitimate manual for activating the Green Dot Debit Cards. Additionally, what users need to do for the situation when they need to Purchase, Activate or Register, and Log In and Open An Account for the individual Green Dot Debit Card account.

Reference Link:

secure.greendot.com/greendot/login