How to Activate a Scotiabank Credit Card :

The Bank of Nova Scotia, operating as Scotiabank, was founded in 1832 in Halifax, is a Canadian worldwide banking and financial service association. Nova Scotia, i.e. the Scotiabank shifted its administrative head office to Toronto, Ontario in the year 1900. Scotiabank has upgraded itself as the “Most global bank of Canada” due to its services basically in Latin America and the Caribbean territories, and Europe, and furthermore in certain regions of Asia.

Scotiabank has served more than 25 million customers globally and offers a wide scope of monetary products and services along with personal and business banking, corporate, and small business banking. The Bank stands as one biggest five banks of Canada and is the third-largest Canadian Bank in regard to asset stores and market capitalization. Nowadays, Scotiabank is listed and trades on the Toronto and New York Stock Exchanges. The organization has a trained workforce of more than 90,000 employees worldwide and resources (as of 31st July 2020) of $1.2 trillion approx.

Presently Scotiabank is one of the main market-leading preeminent banks in the provinces of America. The organization is operating on its inspiration: “for a developed future”, we support and help our customers, their families, and communities to make developmental progress through a wide range of guidance, products, and financial services, including wealth management, individual and business banking, and corporate, private banking, and banking investment.

Guidelines for Scotiabank Credit Card Activation:

To activate your Scotiabank Credit Card, you should follow the below stated process:

- First, go to the main official website of Scotiabank.

- Or else you can click on www.scotiabank.com.

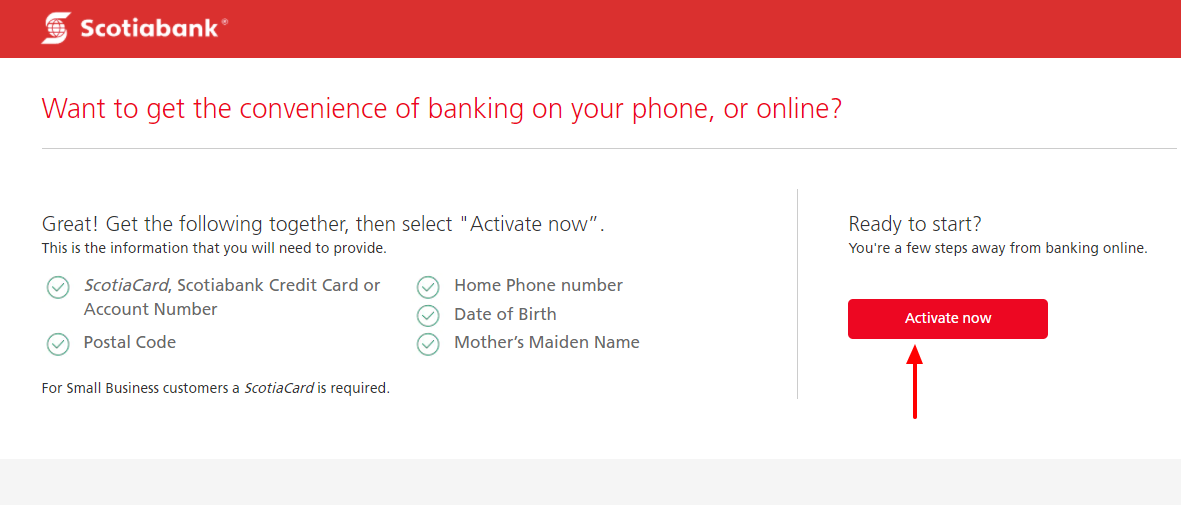

- On the homepage find and click on the “Activate Now” button, just under the “Sign In” red tab above the page.

- On another new webpage, look for the “Activate Now”

- Before going further, keep the information required with you, like your New Credit Card Number, Postal Code, Home Phone number, Date of Birth (DOB), and Mother’s Maiden Name, etc.

- Now tap on the “Activate Now” option, or directly go to www.scotiabank.com/activate page.

- Here on the page select your account type as “Credit Card”.

- Now enter your New Scotiabank Credit Card Number, and press “Continue”.

- Follow the on-screen instructions to finish.

An Alternative Process to Activate Scotiabank Credit Card Online :

- On the Scotiabank homepage, find the “Credit Card”

- Under the “Services” section, find and tap on the “Manage your Card”.

- On the Manage your Account page, you will find the “Activate your Card”

- Press the “Activate your Card”

- Enter your Scotiabank Credit Card Number here, and press “Continue”.

- Following the alternative online process, your card will be activated.

Activation through Phone :

You can also Activate your Scotiabank Credit Card over the telephone which is quick, simple, and convenient. You have to call the Scotiabank Customer Care Service at 1 -800 -806 -8600 and provide your personal data along with card information, now follow to activate.

How to Sign In for Scotiabank Credit Card :

To Sign In for the Scotiabank Credit Card, go with the below guidelines:

- Visit the official website of Scotiabank.

- Or tap on the link given www.scotiabank.com

- Find the “Sign In” tab on the homepage.

- Put down your “Username” or “Card number”.

- Now enter “Password” and press the “Sign In”

How to Apply for Scotiabank Credit Card :

To Apply for the Scotiabank Credit Card, follow the underneath instructions:

- Go to the landing page of Scotiabank.

- Move to the Credit Cards tab, then tap on “Card Types”.

- Here you can select your Credit Card type, as per your requirement.

- On your chosen Credit Card page, you will find the “Apply”

Various Credit Cards offered by Scotiabank :

The bank offers different types of Credit Cards for its customers, like Travel and Lifestyle Credit Cards, Scotiabank Cash Back Credit Cards and Reward Credit Cards, etc. These are briefly discussed below:

Scotiabank – Travel and Lifestyle Credit Cards :

There are almost 5 (five) Travel and Lifestyle credit cards are offered by Scotiabank. These are as follows:

- Scotiabank Passport Visa Infinite Card

- Scotiabank Gold American Express Card

- Scotiabank American Express Card

- Scotiabank Platinum American Express Card

- Scotia Gold Passport Visa Card

Features and Advantages:

- For Scotiabank Passport Visa Infinite Card – Gain up to Scotia Rewards points of 40,000 bonus, in your 1st year (which is equal to $400 travel benefits).

- For Scotiabank Gold American Express Card – You can avail of 40,000 bonus Scotiabank Rewards points within your 1st year (which is equivalent to $400 travel rewards benefits).

- For Scotiabank American Express Card – You can get 5,000 bonus Scotiabank Rewards points with your 1st regular purchase of $500 in the opening 3 (three) months.

- For Scotiabank Platinum American Express Card – You can get unique travel rewards and privileges using this card. Get travel rewards up to 4X quicker, and enjoy the benefits of comprehensive travel insurance along with this card.

- For Scotia Gold Passport Visa Card – Get bundled travel insurances and rewards along with this card.

Rates and Interests for All Travel and Lifestyle Credit Cards:

- For Scotiabank Passport Visa Infinite Card – The annual fee is $139.

- For Scotiabank Gold American Express Card – The annual fee is $120.

- For Scotiabank American Express Card – The annual fee is $0 (No fee).

- For Scotiabank Platinum American Express Card – The annual fee is $399.

- For Scotia Gold Passport Visa Card – The annual fee is $110.

- The Purchase Interest Rate is 19.99%, applicable for all cards.

- The charge for Cash Advances is 22.99%, applicable for all cards.

Scotiabank – Rewards Credit Cards :

There are many Rewards Credit Cards offered by Scotiabank, among them few are briefly discussed below:

- SCENE Visa Card

- Scotiabank GM Visa Card

- Scotiabank GM Visa Infinite Card

Features and Advantages:

- For SCENE Visa Card – Using this card you get 2,500 SCENE bonus points with 1st $500 in your regular purchases.

- For Scotiabank GM Visa Card – Get up to 5% on regular purchases in GM earnings.

- For Scotiabank GM Visa Infinite Card – Get GM earning up to 5% on daily purchases with unlimited enjoyments.

Rates and Interests applicable for All Rewards Cards:

- SCENE Visa Card – No annual fee $0.

- Scotiabank GM Visa Card – No annual fee $0.

- Scotiabank GM Visa Infinite Card – Pay an annual fee of $79.

- Chargeable interest rates for all Rewards Cards are 19.99% on purchases.

- The charge applicable to all cards for Cash Advances is 22.99%.

Scotiabank – Cash Back Credit Cards :

There are 5 (five) Cash Back credit cards are offered by Scotiabank. These are as follows:

- Scotia Momentum Visa Infinite Card

- Scotia Momentum Visa Card

- Scotia Momentum No-Fee Visa Card

- Scotia Momentum Master Card Credit Card

- Learn Visa Card.

Also Read : Guide to Activate Barclaycard Credit Card Online

Features and Advantages :

- For Scotia Momentum Visa Infinite Card – You can earn @ 10% money back on your purchases for 1st 3 (three) months (up to a total purchase of $2,000). Additionally, you get a welcome offer valued at up to $350.

- For Scotia Momentum Visa Card – Get money back up to 7.5% on all approved purchases within opening 3 months valid on total purchase up to $2,000. Additionally, get the benefit of introductory Balance Transfer fees is 2.99% applied for Scotia Momentum Visa Card for opening 6 months, after that 22.99% will be charged.

- For Scotia Momentum No-Fee Visa Card – You can avail @ 1% money back on all approved purchases. Additionally, avail of a welcome offer on regular Purchase Interest of 7.99% for opening 6 months, afterward 19.99% will be charged.

- For Scotia Momentum Mastercard Credit Card – You get a money-back @ 1% on approved gas stations, drug stores, grocery stores, etc.

- For Learn Visa Card Card – Get speedy and quick cashback rewards for students, on using this card.

Rates and Interests (Applicable for All Cash Back Credit Cards) :

- Scotia Momentum Visa Infinite Card – Pay $120 as an annual fee.

- Scotia Momentum Visa Card – Pay $39 as an annual fee.

- Scotia Momentum No-Fee Visa Card – Pay $0 (no fee) as an annual fee.

- Scotia Momentum Master Card Credit Card – No fee ($0) as annual fees.

- Learn Visa Card – – No fee ($0) as annual fees.

- Balance Transfer Fees – Introductory fees are 2.99% applied for Scotia Momentum Visa Card for opening 6 months, after that 22.99% will be charged.

- Purchase Interest – Avail a welcome offer on regular Purchase Interest of 7.99% for Scotia Momentum No-Fee Visa Card for opening 6 months, afterward 19.99% will be charged.

- The charges of Interest Rates on Purchases are 20.99% for Scotia Momentum Visa Infinite Card, all other cards in this category charge 19.99% on purchases.

- The charges for Cash Advances are 22.99%, applicable for all Cash Back Cards in this section.

Contact Details:

44 King St West

Toronto, ON, M5H 1H1

Scotiabank Credit Card Centre and Customer Care :

P.O. Box – 4100, Station A,

Toronto, ON, M5W 1T1

Phone numbers for Scotiabank Credit Cards:

Scotiabank Credit Card Centre:

- (Call): 1-800-387-6466(Canada/USA)

- (Call): (416) 288-1440(Greater Toronto/ outside Canada and USA, call collect through your local Operator)

- (Call): 1-800-645-0288(Services for Deaf, deafened and hard of hearing)

Scotiabank Platinum American Express Card:

- (Call): 1-888-860-5477(Canada/USA)

- (Call): 416-701-7810(Greater Toronto/ outside Canada and USA, call collect through your local Operator)

Scotiabank Gold American Express Card:

- (Call): 1-888-860-7093(Canada/USA)

- (Call): 416-701-7814 (For Greater Toronto and outside Canada and USA, call collect through your local Operator)

Scotiabank American Express Card:

- (Call): 1-888-861-5443(Canada/USA)

- (Call): 416-701-7820 (Greater Toronto/ outside Canada and USA, call collect through your local Operator)

Scotiabank Rewards VISA Cards:

- (Call): 1-888-861-5603(Canada/USA)

- (Call): 416-701-7824 (Greater Toronto/ outside Canada and USA, call collect through your local Operator)

Scotiabank Master Card Credit Cards:

- (Call): English: 1-866-286-4517, and French: 1-866-778-8103

Reference Link :

www.scotiaonline.scotiabank.com